Essay

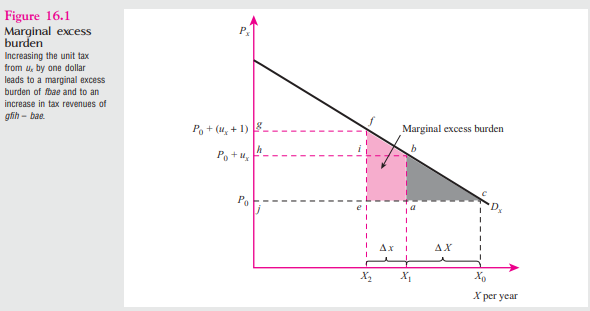

-Refer to Figure 16.1.Assume that the equation of Dx is P = 50 - 2Qd.

(A)If the original price of the good was $10 and a $4 tax was imposed,what is the tax income? What is the excess burden?

(B)How much marginal excess burden will be created if an additional dollar of tax is levied?

(C)How much additional tax is collected?

Correct Answer:

Verified

(A)If the original price of the good was...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Tax avoidance is<br>A) illegal in the United

Q11: A linear income tax schedule is known

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2529/.jpg" alt=" -Refer

Q14: A situation in which the government cannot

Q15: When the minimum marginal penalty for

Q16: Neutral taxation is taxing different commodities at

Q19: Optimal user fees are paid only by

Q20: Changing tax regimes can sometimes be difficult

Q22: Choosing optimal user fees for government produced

Q27: Deciding to engage in tax evasion requires