Essay

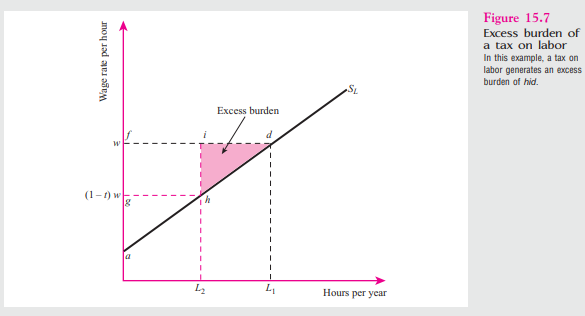

-Refer to Figure 15.7.If the supply curve for labor can be written as L = w/2 - 3/2 and the initial wage was $10,how much excess burden is created if there is a tax on wages of $2?

Correct Answer:

Verified

Excess burden is the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The Double Dividend Effect requires<br>A) double credit

Q11: A tax wedge causes<br>A) consumer prices to

Q14: The tax interaction effect is the _

Q16: When a demand curve is vertical,the

Q17: Excess burden is largest with<br>A)lump-sum taxes.<br>B)unit taxes.<br>C)no

Q20: All taxes impose an excess burden.

Q21: A tax that causes the price that

Q22: A lump sum tax can create an

Q23: Equivalent variation is a method employed to

Q24: The marginal rate of substitution is<br>A)the slope