Multiple Choice

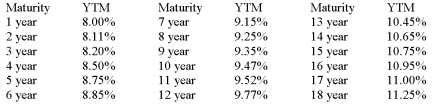

YIELD CURVE FOR ZERO COUPON BONDS RATED AA  Assume that there are no liquidity premiums. To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

Assume that there are no liquidity premiums. To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

A) 9.96 percent

B) 10.41 percent

C) 10.05 percent

D) 10.56 percent

E) 9.16 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Would you expect the demand curve for

Q34: You buy a car for $38,000. You

Q35: A 15-payment annual annuity has its first

Q36: Classify each of the following in terms

Q39: The unbiased expectations hypothesis of the term

Q40: An increase in the marginal tax rates

Q40: According to the unbiased expectations theory,<br>A)the term

Q41: According to the liquidity premium theory of

Q42: The term structure of interest rates is

Q62: The risk that a security cannot be