Multiple Choice

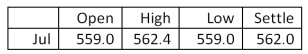

You expect to deliver 40,000 bushels of wheat to the market in July. Today, you hedge your position by selling futures contracts on half of your expected delivery at the final price of the day. Assume that the market price turns out to be 582.0 when you actually deliver the wheat. How much more or less would you have earned if you had not bought the futures contracts?

Wheat - 5,000 bu.:

u.S. cents per bu.

A) $8,000 less

B) $4,000 less

C) neither more nor less

D) $4,000 more

E) $8,000 more

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Farmer Mac owns a large orange grove

Q14: You are the buyer for a cereal

Q18: Suppose you sell nine September silver futures

Q24: The breakdown of the Bretton Woods accord

Q25: Sue recently purchased a right to buy

Q36: A forward contract:<br>A) requires that payment be

Q43: This morning a cereal maker agreed to

Q48: What are the primary motives for a

Q51: Southern Groves raises tangerines. To hedge its

Q63: If a firm creates an interest rate