Multiple Choice

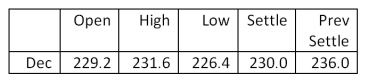

You are the purchasing agent for a major cookie company. You anticipate that your firm will need 20,000 bushels of oats in December. You decide to hedge your position today and did so at the closing price of the day. Assume that the actual market price turns out to be 228.0 on the day you actually buy the oats. How much did you gain or lose by hedging your position?

Oats - 5,000 bu.:

Cents per bu.

A) lost $4,000

B) lost $400

C) saved $40

D) saved $400

E) saved $4,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Which one of the following actions will

Q35: You decided to speculate in the market

Q36: Futures contracts:<br>A)are identical to forward contracts except

Q47: A swap dealer in the U.S.:<br>A) acts

Q60: By hedging financial risk,a firm can:<br>A)ensure a

Q61: Browning Enterprises currently has all fixed-rate debt.The

Q62: Which one of the following statements concerning

Q63: A strong argument can be made that

Q64: Suppose you purchase a September cocoa futures

Q71: Given the following information, what is the