Multiple Choice

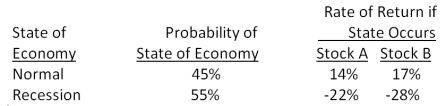

You are comparing stock A to stock B. Given the following information, what is the difference in the expected returns of these two securities?

A) -0.85 percent

B) 1.95 percent

C) 2.05 percent

D) 13.45 percent

E) 13.55 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Suzie owns five different bonds valued at

Q7: Which one of the following is most

Q10: Which one of the following statements related

Q13: A stock has an expected return of

Q16: You recently purchased a stock that is

Q20: If the economy is normal, Charleston Freight

Q47: At a minimum,which of the following would

Q51: The _ of a security divided by

Q76: Thayer Farms stock has a beta of

Q95: Which one of the following is an