Multiple Choice

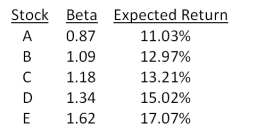

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.2 percent and the market rate of return is 11.76 percent?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: The rate of return on the common

Q29: The expected rate of return on a

Q34: The expected return on a portfolio:<br>I. can

Q36: What is the expected return on a

Q42: You own a portfolio equally invested in

Q45: Which one of the following statements related

Q48: The expected return on a stock given

Q57: Standard deviation measures which type of risk?<br>A)total<br>B)nondiversifiable<br>C)unsystematic<br>D)systematic<br>E)economic

Q65: Which one of the following risks is

Q103: Which one of the following statements is