Multiple Choice

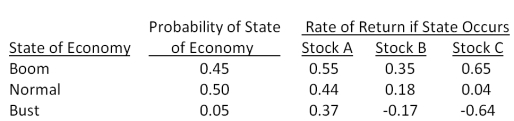

Consider the following information on three stocks:  A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C. What is the expected risk premium on the portfolio if the expected T-bill rate is 3.8 percent?

A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C. What is the expected risk premium on the portfolio if the expected T-bill rate is 3.8 percent?

A) 11.47 percent

B) 12.38 percent

C) 16.67 percent

D) 24.29 percent

E) 29.99 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The _ tells us that the expected

Q18: Treynor Industries is investing in a new

Q26: The expected return on a stock computed

Q30: Which one of the following statements is

Q48: The standard deviation of a portfolio:<br>A)is a

Q54: You own a portfolio that has $2,000

Q56: Consider the following information on Stocks I

Q60: Which one of the following is the

Q69: The risk-free rate of return is 3.9

Q79: The market risk premium is computed by:<br>A)