Multiple Choice

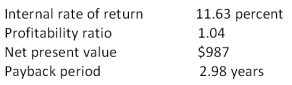

You are considering a project with conventional cash flows and the following characteristics:  Which of the following statements is correct given this information?

Which of the following statements is correct given this information?

I. The discount rate used in computing the net present value was less than 11.63 percent.

II. The discounted payback period must be less than 2.98 years.

III. The discount rate used in the computation of the profitability ratio was 11.63 percent.

IV. This project should be accepted as the internal rate of return exceeds the required return.

A) I and II only

B) III and IV only

C) I, II, and IV only

D) II, III, and IV only

E) I, II, III, and IV

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Which one of the following is an

Q42: You are viewing a graph that plots

Q58: In actual practice,managers frequently use the:<br>I.average accounting

Q63: What is the net present value of

Q70: You would like to invest in the

Q73: Day Interiors is considering a project with

Q74: A project has an initial cost of

Q93: Tedder Mining has analyzed a proposed expansion

Q97: Douglass Interiors is considering two mutually exclusive

Q106: Explain how the internal rate of return