Multiple Choice

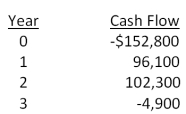

You are considering an investment with the following cash flows. If the required rate of return for this investment is 15.5 percent, should you accept the investment based solely on the internal rate of return rule? Why or why not?

A) Yes; The IRR exceeds the required return.

B) Yes; The IRR is less than the required return.

C) No; The IRR is less than the required return.

D) No; The IRR exceeds the required return.

E) You cannot apply the IRR rule in this case.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The Square Box is considering two projects,

Q8: You are analyzing a project and have

Q9: A firm evaluates all of its projects

Q10: You are considering two independent projects with

Q11: Based on the profitability index rule, should

Q14: A project has a required payback period

Q43: A project has a discounted payback period

Q52: A project has an initial cost of

Q98: The length of time a firm must

Q107: Mutually exclusive projects are best defined as