Multiple Choice

Parnell Industries

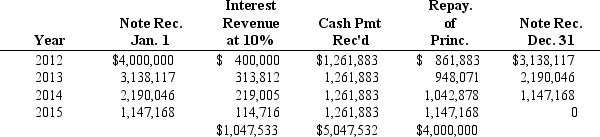

Parnell Industries sold a copy machine to Ranger Inc. on January 1, 2012. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture. Ranger will make four payments at the end of each year, beginning with 2012, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

-If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Falcon Networks<br>Falcon Networks is a leading

Q21: Regarding actuarial assumptions,firms must disclose in notes

Q26: Which of the following is not a

Q38: The projected benefit obligation measures:<br>A) the pension

Q50: When firms use derivatives effectively to manage

Q53: The installment method of revenue recognition can

Q54: The statement of cash flows allows the

Q57: Under the completed contract method<br>A) revenue and

Q58: Many firms use derivative instruments to hedge

Q78: All of the following are events that