Essay

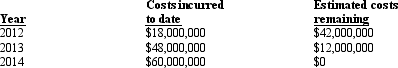

Assume that Madison Corp.has agreed to construct a new basketball arena for Gator Town for $70 million dollars.Construction of the new arena begins in July,2012 and is expected to be completed in March 2009.At the signing of the contract Madison Corp.estimates that the new arena will cost $60 million dollars to build.Given the following cost and building schedule determine the cumulative degree of completion and how much revenue and gross margin Madison Corp.should recognize in years 2012,2013 and 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Firm D holds 20,000 gallons of chemicals

Q17: A derivative has one or more _,which

Q21: Regarding actuarial assumptions,firms must disclose in notes

Q30: Deferred tax assets result in future tax

Q34: Typical U.S.GAAP disclosures for deferred income taxes

Q35: Which of the following calculations is used

Q47: Under the percentage-of-completion contract method<br>A) revenue and

Q49: Under current U.S.GAAP,unrealized gains and losses from

Q68: All of the following conditions signal that

Q72: Deferred tax liabilities result in future tax