Essay

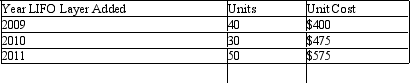

Cooke Industries imports and sells quality merchandise.The company had the following layers in its LIFO inventory at January 1,2012,at which time the replacement cost of the inventory was $600 per unit.

The replacement cost of the merchandise remained constant throughout 2012.Cooke sold 300 units during 2012.The company established the selling price of each unit by doubling its replacement cost at the time of sale.

The replacement cost of the merchandise remained constant throughout 2012.Cooke sold 300 units during 2012.The company established the selling price of each unit by doubling its replacement cost at the time of sale.

Required:

1.Determine the gross margin and the gross margin percentage for 2012 assuming that Cooke purchased 310 units during the year.

2.Determine the gross margin and the gross margin percentage for 2012 assuming that Cooke purchased 200 units during the year.

3.Explain why the assumed number of units purchased makes a difference in your answers.

Correct Answer:

Verified

1.

2.

2.

3.

When prices are rising,sel...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

3.

When prices are rising,sel...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Please answer the following questions about defined

Q15: Presented below is pension information related to

Q17: Parnell Industries Parnell Industries sold a copy

Q18: Firm A places its order for the

Q20: The following information is related to the

Q27: When input prices are increasing,companies that use

Q28: The process of allocating the historical cost

Q39: Although LIFO generally provides higher quality earnings

Q58: Accountants use reserve accounts for various reasons,for

Q63: Under the accrual method of accounting,when a