Multiple Choice

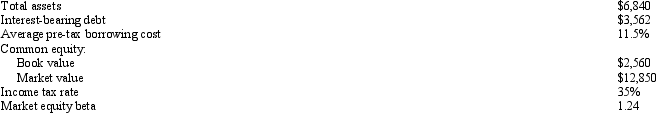

Zonk Corp. The following data pertains to Zonk Corp.,a manufacturer of ball bearings (dollar amounts in millions) : Using the above information,calculate Zonk's weighted-average cost of capital:

Using the above information,calculate Zonk's weighted-average cost of capital:

A) 11.5%

B) 11.89%

C) 7.48%

D) 10.90%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: To determine the appropriate weights to use

Q9: The historical discount rate of the firm

Q17: Identify the types of firm-specific factors that

Q20: Conceptually,why should an analyst expect the dividends

Q25: Provide the rationale for using expected dividends

Q31: The dividends valuation approach measures value-relevant dividends

Q32: Bridgetron<br>An analyst wants to value the sum

Q33: In what case will using dividends expected

Q39: Returns on systematic risk-free securities (like U.S.Treasury

Q39: In some valuation scenarios,such as a leveraged