Essay

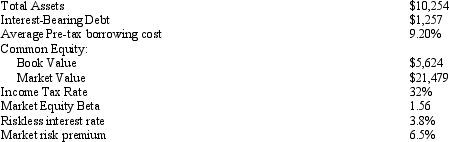

The following data pertain to Loren Corporation (dollar amounts in thousands):

Using this information,calculate the following:

Using this information,calculate the following:

a.Loren Corporation's cost of equity capital

b.The weight on debt capital that should be used to calculate Loren's weighted-average cost of capital.

c.Loren Corporation's weighted-average cost of capital

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The CAPM computes expected rates of return

Q8: Explain why analysts and investors use risk-adjusted

Q27: Equity valuation models based on dividends,cash flows,and

Q31: Carr Industries must raise $100 million on

Q31: The dividends valuation approach measures value-relevant dividends

Q32: Bridgetron<br>An analyst wants to value the sum

Q33: In what case will using dividends expected

Q35: All of the following are steps in

Q39: Returns on systematic risk-free securities (like U.S.Treasury

Q48: Why are dividends value-relevant to common equity