Essay

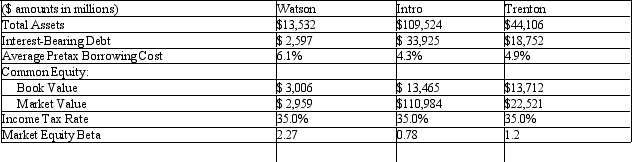

Watson manufactures and sells appliances.Intro develops and manufactures computer technology.Trenton operates general merchandise retail stores.Selected data for these companies appear in the following table (dollar amounts in millions).For each firm,assume that the market value of the debt equals its book value.

Required

Required

a.Assume that the intermediate-term yields on U.S.Treasury securities

are roughly 3.5 percent.Assume that the market risk premium is 5.0 percent.

Compute the cost of equity capital for each of the three companies.

b.Compute the weighted average cost of capital for each of the three companies.

c.Compute the unlevered market (asset)beta for each of the three companies.

Calculating the Cost of Capital.(Dollar Amounts in Millions)

Correct Answer:

Verified

Calculating the Cost of Capital.(Dollar ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Explain the theory behind the dividends valuation

Q6: Firm-specific factors that increase the firm's nondiversifiable

Q9: The historical discount rate of the firm

Q11: With respect to dividends and priority in

Q13: When deriving the equity value of a

Q16: If dividend projections include the effect of

Q25: Provide the rationale for using expected dividends

Q38: If a firm has a market beta

Q44: Dividends measure the cash that _ ultimately

Q45: One criticism in using the CAPM to