Essay

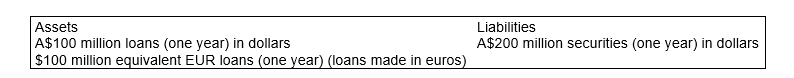

Suppose an FI has the following assets and liabilities: To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

At the beginning of the year, it sold $100 million for euros on the spot currency markets at an exchange rate of A$2 to €1.

It takes the equivalent euro amount and makes one-year euro loans at a 15 per cent interest rate.

At the end of the year, the Australian FI repatriates the funds back to Australia at the same spot currency market rate of A$2/ €1.

a) Calculate the equivalent euro amount of $100 million using the spot exchange rate stated in transaction (1).

b) Calculate the value of the euro assets at the end of the year.

c) Calculate the dollar proceed of the euro investment.

d) Assume that the A$100 million loans yield a rate of 10 per cent p.a. What is the FI's weighted return on investments?

Correct Answer:

Verified

a) At the beginning of the year, the Aus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Assume an FI sells A$100 million for

Q24: An FI's net exposure can be measured

Q25: Assume an Australian FI has US$100 000

Q26: A US FI wishes to hedge a

Q34: Which of the following statements is true?<br>A)The

Q47: Explain the concept of the interest rate

Q50: Explain how forward contracts can be used

Q53: Off-balance-sheet hedging involves making changes in the

Q60: Which of the following statements is true?<br>A)Conceptually,

Q74: Which of the following statements is true