Multiple Choice

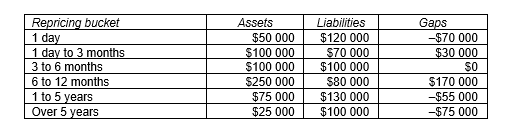

Consider the following repricing buckets and gaps:  What is the annualised change in the bank's future net interest income if the average rate change for assets and liabilities that can be repriced within one year is a decrease of 100 basis points?

What is the annualised change in the bank's future net interest income if the average rate change for assets and liabilities that can be repriced within one year is a decrease of 100 basis points?

A) $17 000

B) -$17 000

C) $13 000

D) -$13 000

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Would you consider the repricing model to

Q20: Which of the following statements is true?<br>A)One

Q31: Which of the following statements is true?<br>A)A

Q35: How do you interpret the position of

Q51: What is meant by the 'runoff' problem

Q57: Consider the following information to answer the

Q58: Which of the following are rate-sensitive liabilities?<br>A)

Q63: Which of the following statements is true?<br>A)An

Q69: An FI with a positive gap of

Q71: Over-aggregation and runoffs are the major problems