Multiple Choice

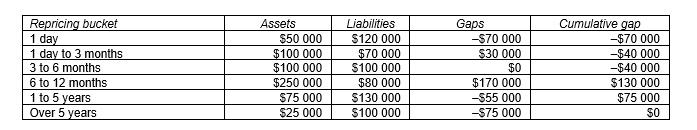

Consider the following repricing buckets and gaps:  What is the annualised change in the bank's future net interest income if the average rate change for assets and liabilities that can be repriced over five years is an increase of 50 basis points?

What is the annualised change in the bank's future net interest income if the average rate change for assets and liabilities that can be repriced over five years is an increase of 50 basis points?

A) $7500

B) $0

C) No enough information to answer the question.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The market segmentation theory of the term

Q12: Consider the following repricing buckets and gaps:

Q15: Which of the following are rate-sensitive assets?<br>A)

Q18: In the last quarter ABC Bank reported

Q24: Which of the following statements is true?<br>A)The

Q29: The cumulative gap over the whole balance

Q42: The repricing gap focuses on the interest

Q43: The liquidity premium theory of the term

Q44: An FI with a positive repricing gap

Q55: Which of the following statements is true?<br>A)A