Multiple Choice

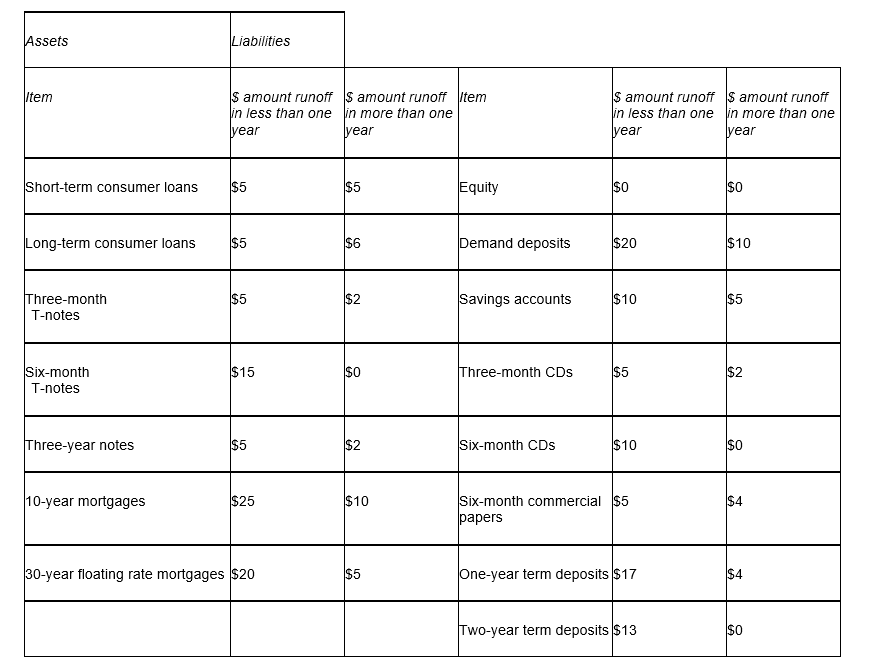

Consider the following table:  How does an increase in the average one-year interest rate of 50 basis points affect the FI's future net interest income ?

How does an increase in the average one-year interest rate of 50 basis points affect the FI's future net interest income ?

A) The NII will not change.

B) The NII will increase by $50.

C) The NII will increase by $5.

D) The NII will decrease by $50.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The repricing model ignores information regarding the

Q3: The term 'rate-sensitive assets' refers to assets:<br>A)whose

Q8: Which of the following statements is true?<br>A)An

Q10: Which of the following statements is true?<br>A)As

Q28: Convexity is the major problem associated with

Q37: The term 'runoffs' refers to:<br>A)one-off cash flow

Q40: An FI with a negative gap of

Q43: The Reserve Bank of Australia's (RBA) undertook

Q75: The unbiased expectations theory of the term

Q104: Because the repricing model ignores the market