Essay

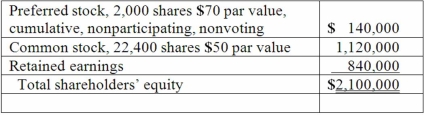

On January 1, 2013, Bast Co. had a net book value of $2,100,000 as follows:

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Knight Co. owned 80% of the common

Q9: The following information has been taken from

Q30: Panton, Inc. acquired 18,000 shares of

Q33: The following information has been taken from

Q35: How does the existence of a noncontrolling

Q36: Where do intra-entity sales of inventory appear

Q57: Knight Co. owned 80% of the common

Q64: Fargus Corporation owned 51% of the voting

Q80: Keenan Company has had bonds payable of

Q101: How would consolidated earnings per share be