Essay

On January 1, 2013, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.

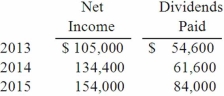

Carper earned income and paid cash dividends as follows:  On December 31, 2015, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

On December 31, 2015, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2015?

From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.

Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: When Jolt Co. acquired 75% of the

Q49: MacHeath Inc. bought 60% of the outstanding

Q74: On January 1, 2014, Glenville Co. acquired

Q76: Which of the following statements is false

Q104: McGuire Company acquired 90 percent of

Q107: Pell Company acquires 80% of Demers

Q108: Pell Company acquires 80% of Demers

Q110: Pell Company acquires 80% of Demers

Q113: Pell Company acquires 80% of Demers

Q114: Pell Company acquires 80% of Demers