Essay

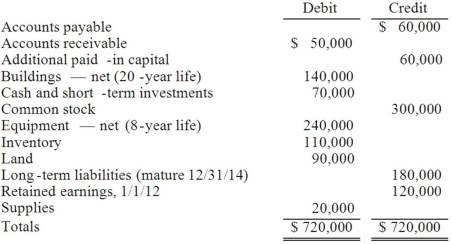

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2012. As of that date, Jackson had the following trial balance:  During 2012, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2013, Jackson reported net income of $132,000 while paying dividends of $36,000.

During 2012, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2013, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2012, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2012.

(B.) Prepare consolidation worksheet entries for December 31, 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Racer Corp. acquired all of the common

Q38: Under the initial value method, when accounting

Q43: One company acquires another company in a

Q64: For an acquisition when the subsidiary maintains

Q69: All of the following are acceptable methods

Q71: Fesler Inc. acquired all of the outstanding

Q92: Which of the following is false regarding

Q114: Kaye Company acquired 100% of Fiore Company

Q117: Perry Company acquires 100% of the

Q122: What accounting method requires a subsidiary to