Essay

On January 1, 2011, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

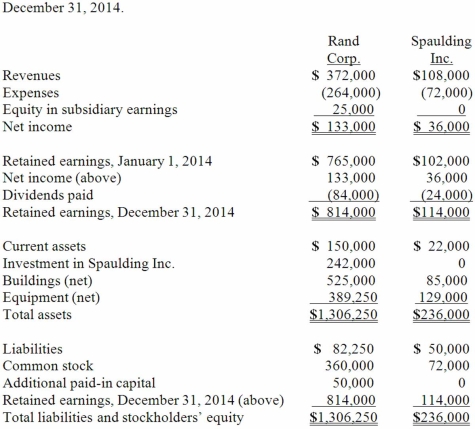

Following are the individual financial records for these two companies for the year ended December 31, 2014.

Required:

Required:

Prepare a consolidation worksheet for this business combination.

Correct Answer:

Verified

Consolidat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: How is the fair value allocation of

Q53: Jansen Inc. acquired all of the outstanding

Q67: Following are selected accounts for Green

Q68: Following are selected accounts for Green

Q69: How does the partial equity method differ

Q75: Perry Company acquires 100% of the

Q77: Paperless Co. acquired Sheetless Co. and in

Q83: What is the partial equity method? How

Q98: Cashen Co. paid $2,400,000 to acquire all

Q116: Carnes Co. decided to use the partial