Essay

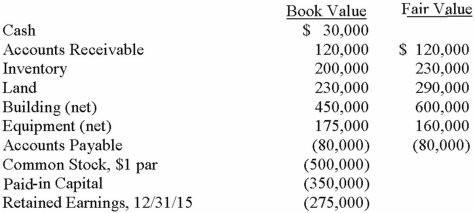

On January 1, 2013, Chester Inc. acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock. On January 1, 2013, Chester's voting common stock had a fair value of $40 per share. Festus' voting common shares were selling for $6.50 per share. Festus' balances on the acquisition date, just prior to acquisition are listed below.  Required:

Required:

Compute the value of the Goodwill account on the date of acquisition, 1/1/15.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The financial statements for Goodwin, Inc.

Q3: The financial balances for the Atwood

Q4: Prior to being united in a

Q5: Flynn acquires 100 percent of the

Q6: The financial statements for Goodwin, Inc.

Q7: On January 1, 2013, the Moody

Q8: The financial statements for Goodwin, Inc.

Q10: On January 1, 2013, the Moody

Q52: How are direct combination costs accounted for

Q91: Which one of the following is a