Multiple Choice

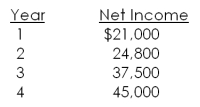

An investment has an initial cost of $410,000 and will generate the net income amounts shown below. This investment will be depreciated straight line to zero over the 4-year life of the project. Should this project be accepted based on the average accounting rate of return if the required rate is 16 percent? Why or why not?

A) Yes; because the AAR is equal to 16 percent

B) Yes; because the AAR is greater than 16 percent

C) Yes; because the AAR is less than 16 percent

D) No; because the AAR is greater than 16 percent

E) No; because the AAR is less than 16 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Based on the most recent survey information

Q21: The net present value of an investment

Q72: If an investment is producing a return

Q86: A project has the following cash flows.

Q87: You were recently hired by a firm

Q88: Which one of the following statements is

Q89: What is the payback period for a

Q90: Miller and Sons is evaluating a project

Q92: A project has the following cash flows.

Q96: A project has the following cash flows.