Multiple Choice

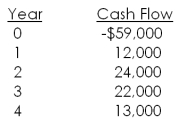

The Flour Baker is considering a project with the following cash flows. Should this project be accepted based on its internal rate of return if the required return is 11 percent?

A) Yes; the project's rate of return is 7.78 percent

B) Yes; the project's rate of return is 9.36 percent

C) No; the project's rate of return is 7.78 percent

D) No; the project's rate of return is 9.36 percent

E) No; the project's rate of return is 13.08 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The net present value:<br>A)decreases as the required

Q20: EEG, Inc. is considering a new project

Q21: Alpha Zeta is considering purchasing some new

Q22: A project has the following cash flows.

Q26: Baker's Supply imposes a payback cutoff of

Q27: Services United is considering a new project

Q46: Which one of the following is most

Q68: The net present value profile illustrates how

Q86: The payback method of analysis ignores which

Q101: Which one of the following is an