Multiple Choice

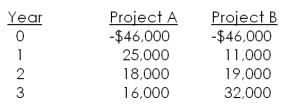

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. Which project should you accept and what is the best reason for that decision?

A) Project A; because it pays back faster

B) Project A; because it has the higher internal rate of return

C) Project B; because it has the higher internal rate of return

D) Project A; because it has the higher net present value

E) Project B; because it has the higher net present value

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If a project with conventional cash flows

Q7: The modified internal rate of return is

Q9: Diamond Enterprises is considering a project that

Q11: What is the payback period for a

Q12: What is the IRR of the following

Q13: What is the net present value of

Q15: You are using a net present value

Q17: Professional Properties is considering remodeling the office

Q18: Chestnut Tree Farms has identified the following

Q19: You are considering the following two mutually