Multiple Choice

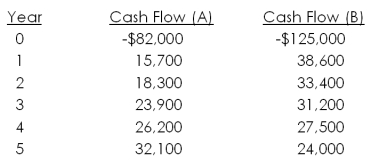

Quattro, Inc. has the following mutually exclusive projects available. The company has historically used a 4-year cutoff for projects. The required return is 11 percent.  The payback for Project A is ____ while the payback for Project B is _____. The NPV for Project A is _____ while the NPV for Project B is _____. Which project, if any, should the company accept?

The payback for Project A is ____ while the payback for Project B is _____. The NPV for Project A is _____ while the NPV for Project B is _____. Which project, if any, should the company accept?

A) 3.92 years; 3.64 years; $780.85; $1,211.48; accept both Project A and B

B) 3.92 years; 3.79 years; -$211.60; $1,211.48; accept Project B only

C) 3.92 years; 3.79 years; $780.85; -$7,945.93; accept Project A only

D) 4.06 years; 3.64 years; $780.85; $1,211.48; accept both Project A and B

E) 4.06 years; 3.79 years; -$211.60; -$7,945.93; reject both projects

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Which one of the following is the

Q14: Miller Brothers is considering a project that

Q17: Ed has to choose between Project A

Q53: Mary has just been asked to analyze

Q58: The Steel Factory is considering a project

Q106: You are considering an investment for which

Q107: An investment has conventional cash flows and

Q108: Identify one primary strength and one primary

Q110: Which one of the following methods of

Q114: Benny's is considering adding a new product