Essay

First Bank recognized an extraordinary loss from the settlement of a lawsuit with Fifth Street Bank that it had impeded on a processing patent.The extraordinary loss was in the amount of $4,250,000 and First Bank Corporation has an effective tax rate of 35%.First Bank paid the settlement immediately and recognized the tax benefit as a receivable to offset the current period's taxes.

Instructions:

a.Prepare the extraordinary item portion of First Bank Corporation's financial statement.

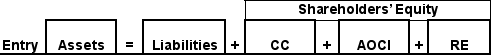

b.Using the analytical framework discussed in the text and reprinted below show the effect of following event on First Bank Corporation's financial statements.

Analytical Framework:

Correct Answer:

Verified

a.Extraordinary loss on the se...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: When evaluating the quality of accounting information

Q51: Users of financial statements should consider which

Q52: Under new accounting standards passed in 2006

Q53: Healy and Wahlen state that one type

Q54: Accounting information should provide a fair and

Q55: As transitory components become a more important

Q57: Firms' choices and estimates within U.S.GAAP or

Q58: Motor Corporation's income statements for the

Q59: Accounting information should provide relevant information to

Q60: Under current GAAP unrealized gains and losses