Multiple Choice

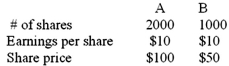

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is,after the merger,there are 2500 shares of A outstanding) .If investors are aware that there are no economic gains from the merger,what is the price-earnings ratio of A's stock after the merger?

A) 7.5

B) 8.3

C) 10.0

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The following are methods available to change

Q7: Firm A has a value of $200

Q42: The following data on a merger

Q44: Briefly discuss takeover defenses.

Q48: Many mergers that appear to make economic

Q49: Given the following data: <span

Q52: Compensation paid to top management in the

Q55: The market for corporate control includes<br>I.mergers;<br>II.spin-offs and

Q64: Briefly discuss the different forms of acquisition.

Q74: Supermajorities give shareholders more control over the