Multiple Choice

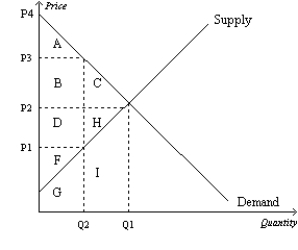

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.

-Refer to Figure 8-5.Producer surplus before the tax was levied is represented by area

A) A.

B) A+B+C.

C) D+H+F.

D) F.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: When a good is taxed,<br>A)both buyers and

Q137: Suppose a tax of $5 per unit

Q188: What happens to the total surplus in

Q200: Figure 8-4<br>The vertical distance between points A

Q201: Figure 8-5<br>Suppose that the government imposes a

Q202: A tax placed on a good<br>A)causes the

Q205: In the market for widgets,the supply curve

Q206: Figure 8-3<br>The vertical distance between points A

Q207: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-1

Q208: Figure 8-12 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-12