Multiple Choice

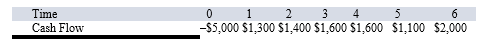

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

A) Payback = 4.44 years; reject

B) Payback = 3.44 years; accept

C) Payback = 3.54 years; reject

D) Payback = 3.24 years; reject

Correct Answer:

Verified

Correct Answer:

Verified

Q17: All of the following capital budgeting tools

Q55: Suppose your firm is considering two

Q55: Which of the following tools is suitable

Q59: Which of the following best describes the

Q63: Which of the following is a technique

Q84: A capital budgeting technique that generates a

Q95: All of the following are strengths of

Q107: A project costs $91,000 today and is

Q109: A project costs $101,000 today and is

Q117: A firm is evaluating a potential investment