Essay

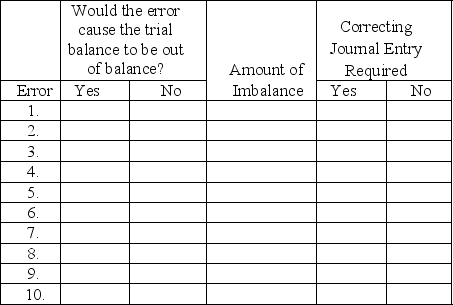

At year-end, Henry Laundry Service, Inc. noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Henry was recorded as a debit to Common Stock and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal by the stockholder was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Correct Answer:

Verified

Correct Answer:

Verified

Q55: The accounting process begins with:<br>A) Analysis of

Q67: Identify the account below that is classified

Q102: Identify the correct formula below used to

Q103: A company's list of accounts and the

Q113: A general journal is:<br>A)A ledger in which

Q142: Dividends are not reported on a business's

Q155: Joe Jackson opened Jackson's Repairs, Inc. on

Q170: Identify the statement below that is incorrect.<br>A)The

Q182: A transaction that decreases a liability and

Q192: A business's general journal provides a place