Essay

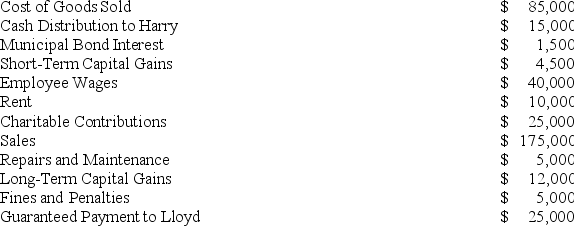

Lloyd and Harry,equal partners,form the Ant World Partnership.During the year,Ant World had the following revenue,expenses,gains,losses,and distributions:

Given these items,what amount of ordinary business income (loss)and what separately-stated items should be allocated to each partner for the year?

Given these items,what amount of ordinary business income (loss)and what separately-stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Which of the following items are subject

Q35: If a taxpayer sells a passive activity

Q47: Which of the following would not be

Q52: On January 1,20X9,Mr.Blue and Mr.Grey each contributed

Q62: For partnership tax years ending after December

Q70: The term "outside basis" refers to the

Q76: Styling Shoes, LLC filed its 20X8 Form

Q77: A partner's outside basis must first be

Q105: Tom is talking to his friend Bob,

Q131: Explain why partners must increase their tax