Essay

Alfred,a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership.Unfortunately,the Schedule K-1 he recently received was for year 3 of the partnership,but Alfred only knows that his tax basis at the beginning of year 2 of the partnership was $23,000.Thankfully,Alfred still has his Schedule K-1 from the partnership for years 1 and 2.

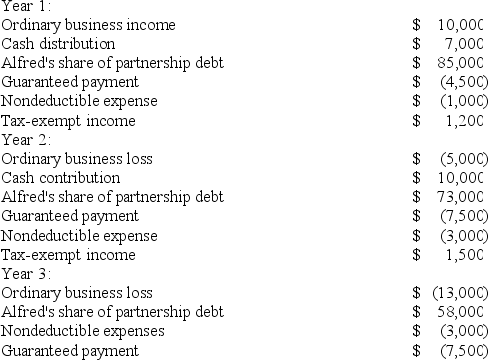

Using the following information from Alfred's year 1,year 2,and year 3 Schedule K-1,calculate his tax basis the end of year 2 and year 3.

Correct Answer:

Verified

At the end of year 2,Alfred's basis is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: In what order are the loss limitations

Q10: A partnership with a C corporation partner

Q23: The main difference between a partner's tax

Q28: Guaranteed payments are included in the calculation

Q57: Actual or deemed cash distributions in excess

Q70: J&J,LLC was in its third year of

Q71: TQK,LLC provides consulting services and was formed

Q82: Which of the following statements exemplifies the

Q89: Which of the following statements is true

Q90: On March 15, 20X9, Troy, Peter, and