Essay

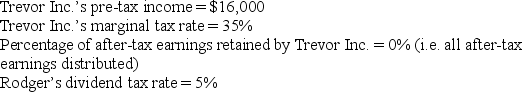

Rodger owns 100% of the shares in Trevor Inc.,a C corporation.Assume the following for the current year:

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q42: Which of the following legal entities are

Q44: Which of the following entity characteristics are

Q45: While a C corporation's losses cannot be

Q47: If an individual forms a sole proprietorship,

Q49: For the current year,Birch Corporation,a C corporation,reports

Q49: On which form is income from a

Q52: If individual taxpayers are the shareholders of

Q73: On which tax form does a single-member

Q74: Corporations are legally formed by filing articles

Q87: Corporations are legally better suited for taking