Multiple Choice

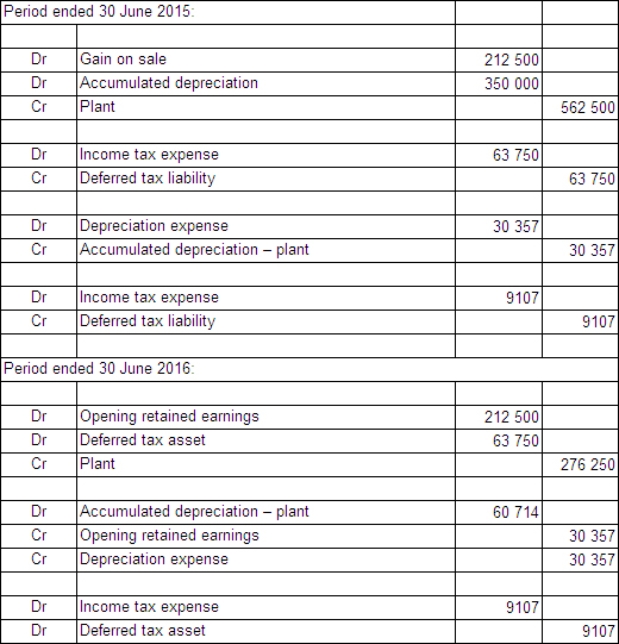

Apple Plc owns all the issued capital of Pear Plc.On 1 July 2014,Pear Plc purchased an item of plant from Apple Plc for £1 000 000.Apple Plc had owned the plant for 5 years.It originally cost £1 350 000 and the accumulated depreciation at 1 July 2004 is £562 500.The remaining useful life of the equipment on the date of sale to Pear Ltd is estimated to be 7 years.The pattern of benefits is expected to be obtained from the equipment evenly over its useful life.The tax rate is 30%.Round all calculations to the nearest dollar. What are the consolidation journal entries required for this inter-company transaction for the periods ended 30 June 2015 and 30 June 2016?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dividends may be identified as being paid

Q5: The fact that consolidation worksheets start 'afresh'

Q6: Explain why gains recognised on sale of

Q32: Radio Ltd acquired all the issued

Q34: Woody Plc sold inventory items to its

Q37: Examples of intragroup transactions include:<br>A) dividends payable

Q39: IFRS 10 Consolidated Financial Statements prescribes that

Q40: What is the amount of unrealised profit

Q45: Companies A,B and C are all part

Q48: Explain the accounting treatment for impairment to