Multiple Choice

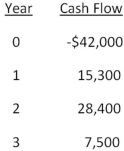

An investment has the following cash flows and a required return of 13 percent.Based on IRR,should this project be accepted? Why or why not?

A) No; The IRR exceeds the required return by about 0.06 percent.

B) No; The IRR is less than the required return by about 1.53 percent.

C) Yes; The IRR exceeds the required return by about 0.06 percent.

D) Yes; The IRR exceeds the required return by about 1.53 percent.

E) Yes; The IRR is less than the required return by about 0.06 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: You are considering the following two mutually

Q21: You are considering the following two mutually

Q27: Which two methods of project analysis were

Q54: A project has an initial cost of

Q58: In actual practice,managers frequently use the:<br>I.average accounting

Q61: An investment project provides cash flows of

Q69: A project has an initial cost of

Q83: Rossiter Restaurants is analyzing a project that

Q89: An investment project has an installed cost

Q90: Which one of the following statements related