Multiple Choice

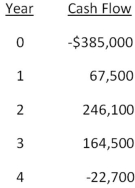

Sheakley Industries is considering expanding its current line of business and has developed the following expected cash flows for the project.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 13.4 percent? Why or why not?

A) Yes; The MIRR is 6.50 percent.

B) No; The MIRR is 8.67 percent.

C) Yes; The MIRR is 8.23 percent.

D) No; The MIRR is 6.50 percent.

E) No; The MIRR is 7.59 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A project that provides annual cash flows

Q25: The internal rate of return is defined

Q48: If a firm accepts Project A it

Q54: Motor City Productions sells original automotive

Q57: You are considering two independent projects with

Q58: The relevant discount rate for the following

Q60: Day Interiors is considering a project

Q61: Cool Water Drinks is considering a

Q68: You are considering a project with an

Q78: Explain the differences and similarities between net