Multiple Choice

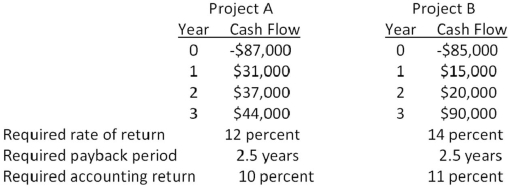

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on IRR analysis?

Should you accept or reject these projects based on IRR analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on internal rate of return analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: An investment project costs $21,500 and has

Q17: Graphing the crossover point helps explain: <br>A) why

Q20: A project produces annual net income of

Q38: Which one of the following methods determines

Q43: A project has a discounted payback period

Q63: It will cost $6,000 to acquire an

Q74: A project has an initial cost of

Q111: Blue Water Systems is analyzing a

Q112: You would like to invest in the

Q115: You are analyzing a project and have