Multiple Choice

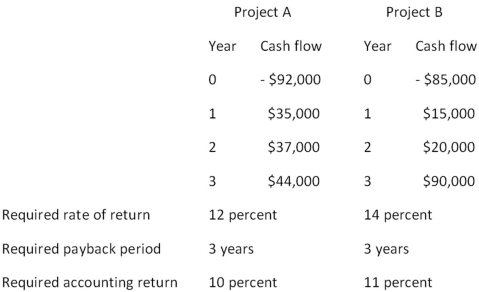

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on payback analysis?

Should you accept or reject these projects based on payback analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on payback analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Alicia is considering adding toys to her

Q18: A project will produce cash inflows of

Q22: Which one of the following is a

Q26: A firm evaluates all of its projects

Q28: Consider the following two mutually exclusive

Q32: A project's average net income divided by

Q38: The internal rate of return: <br>A) may produce

Q85: The present value of an investment's future

Q98: The length of time a firm must

Q106: Explain how the internal rate of return