Multiple Choice

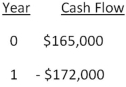

Rosa's Designer Gowns creates exquisite gowns for special occasions on a prepaid basis only.The required return is 8 percent.Rosa has estimated the cash flows for one gown as follows.Should Rosa sell this gown at the price she is currently considering based on the estimated internal rate of return (IRR) ?

A) Rosa should sell the gown for $155,000.

B) Rose can sell the gown for as little as $153,819 and still earn her required return.

C) The gown must be sold for a minimum price of $159,259 if Rosa is to earn her required return.

D) The IRR decision rule cannot be applied to this project.

E) Insufficient information is provided to make a decision based on IRR.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What is the net present value of

Q9: You are analyzing a project and

Q13: Home Décor & More is considering

Q37: Which one of the following is an

Q48: Which two methods of project analysis are

Q50: How does the net present value (NPV)decision

Q54: A project has an initial cost of

Q64: Roger's Meat Market is considering two independent

Q69: A project has an initial cost of

Q82: The Green Fiddle is considering a project