Multiple Choice

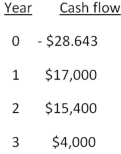

A firm evaluates all of its projects by applying the IRR rule.The required return for the following project is 21 percent.The IRR is _____ percent and the firm should ______ the project.

A) 16.05 percent; reject

B) 16.05 percent; accept

C) 24.26 percent; reject

D) 26.30 percent; accept

E) 26.30 percent; reject

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which one of the following increases the

Q4: A project with financing type cash flows

Q5: Which of the following are advantages of

Q23: Applying the discounted payback decision rule to

Q33: The profitability index (PI)of a project is

Q38: The internal rate of return: <br>A) may produce

Q57: The length of time a firm must

Q67: Which of the following are considered weaknesses

Q90: Which one of the following will decrease

Q115: Net present value:<br>A)is the best method of