Multiple Choice

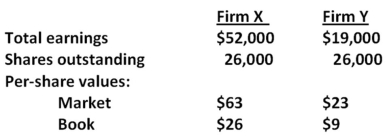

Consider the following premerger information about Firm X and Firm Y:  Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

A) $1,274,000

B) $1,316,000

C) $1,352,000

D) $1,422,000

E) $1,427,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Sleep Tight is acquiring Restful Inns for

Q37: Aardvark Enterprises has agreed to be acquired

Q79: Hanover Tires is being acquired by Better

Q80: Penn Corp.is analyzing the possible acquisition of

Q81: The Daily News published an ad today

Q83: Nelson's Interiors has $1.52 million in net

Q85: Which of the following increase the costs

Q87: Johnson Manufacturers and Peabody Enterprises are both

Q88: Which of the following is a form

Q89: Alpha is planning on merging with Beta.Alpha