Multiple Choice

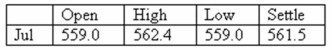

You expect to deliver 42,000 bushels of wheat to the market in July.Today,you hedge your position by selling futures contracts on half of your expected delivery at the final price of the day.Assume that the market price turns out to be 582.0 when you actually deliver the wheat.How much more or less would you have earned if you had not bought the futures contracts?

Wheat - 5,000 bu.:

U.S.cents per bu.

A) $8,000 less

B) $4,305 less

C) neither more nor less

D) $4,305 more

E) $8,000 more

Correct Answer:

Verified

Correct Answer:

Verified

Q19: You are the purchasing agent for a

Q20: Which two of the following are key

Q21: Dog's can borrow money at either a

Q22: You are a jewelry maker.In May of

Q23: An option contract:<br>I.can be used to hedge

Q25: Sue recently purchased a right to buy

Q26: What was the highest price per troy

Q27: You own three January futures contracts on

Q28: Which one of the following can a

Q29: Explain why a swap is effectively a