Multiple Choice

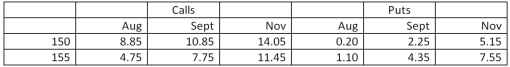

Suppose you purchase the November call option on orange juice futures with a strike price of 150 at the price shown in the table below.What will be your profit or loss on this contract if the price of orange juice futures is $0.616 per pound at expiration of the option contract?

Futures Options

Orange juice:

15,000 lbs,U.S.cents per lb.

A) loss of $2,107.50

B) loss of $1,717.50

C) no profit or loss

D) profit of $1,717.50

E) profit of $2,107.50

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Farmer Mac owns a large orange grove

Q4: Steve recently sold an option that requires

Q5: Suppose your firm produces breakfast cereal and

Q6: You believe the price of a stock

Q7: Most of the evidence to-date indicates that

Q9: What is cross-hedging?<br> Why do you suppose

Q10: Murray's can borrow money at a fixed

Q11: Farmer Jones raises several hundred acres of

Q13: Which one of the following actions will

Q25: An agreement that grants its owner the