Multiple Choice

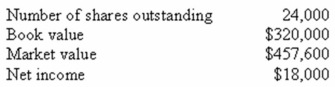

Birds and More is considering a project which requires the purchase of $175,000 of fixed assets.The net present value of the project is $4,500.Equity shares will be issued as the sole means of financing this project.The price-earnings ratio of the project equals that of the existing firm.What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $18.68

B) $18.72

C) $18.80

D) $19.20

E) $21.10

Correct Answer:

Verified

Correct Answer:

Verified

Q34: You own 15 percent or 13,500 shares

Q35: Blue Stone Builders recently offered to sell

Q36: Webster Electrics is offering 1,500 shares of

Q37: Jefferson Refining is issuing a rights offering

Q38: Jones & Co.is funded by a group

Q40: Kurt currently owns 3.4 percent of Northeastern

Q41: Bakers' Town Bread is selling 1,200 shares

Q42: The Woods Co.and the Mickelson Co.have both

Q43: The Educated Horses Corporation needs to raise

Q44: Which one of the following statements concerning