Multiple Choice

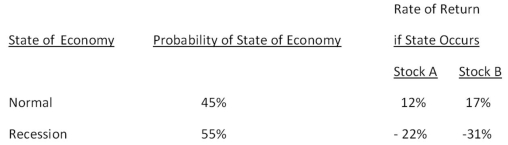

You are comparing stock A to stock B.Given the following information,what is the difference in the expected returns of these two securities?

A) -0.85 percent

B) 2.70 percent

C) 3.05 percent

D) 13.45 percent

E) 13.55 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q48: The expected return on a stock given

Q65: Which one of the following risks is

Q66: You have a portfolio consisting solely of

Q68: How many diverse securities are required to

Q69: The risk-free rate of return is 3.9

Q71: Explain how the beta of a portfolio

Q73: The common stock of United Industries has

Q74: The common stock of Jensen Shipping has

Q75: Which of the following statements are correct

Q94: The intercept point of the security market