Multiple Choice

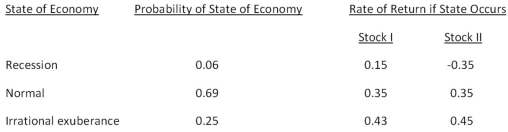

Consider the following information on Stocks I and II:  The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

A) 2.08; 2.47

B) 2.08; 2.76

C) 3.21; 3.84

D) 4.47; 3.89

E) 4.03; 3.71

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q75: Which of the following statements are correct

Q76: Thayer Farms stock has a beta of

Q77: What is the standard deviation of the

Q78: The returns on the common stock of

Q79: The market has an expected rate of

Q81: You recently purchased a stock that is

Q82: You own the following portfolio of stocks.What

Q83: Which one of the following indicates a

Q84: What is the standard deviation of the

Q85: What is the expected return on a